What is Automated KYC Verification?

Know Your Customer (KYC) regulations require contact centres to verify the identity of the caller. The traditional method of asking for personal information, like date of birth or address, is often not secure and takes up a lot of time for both agents and customers. Automated KYC Verification makes it faster and more secure by eliminating the need for agent involvement. It can also use Voice Verification technology to match the caller's voice to their stored voiceprint.

BENEFITS AND RESULTS: AUTOMATED KYC VERIFICATION

How does Oration’s Automated KYC Verification feature work?

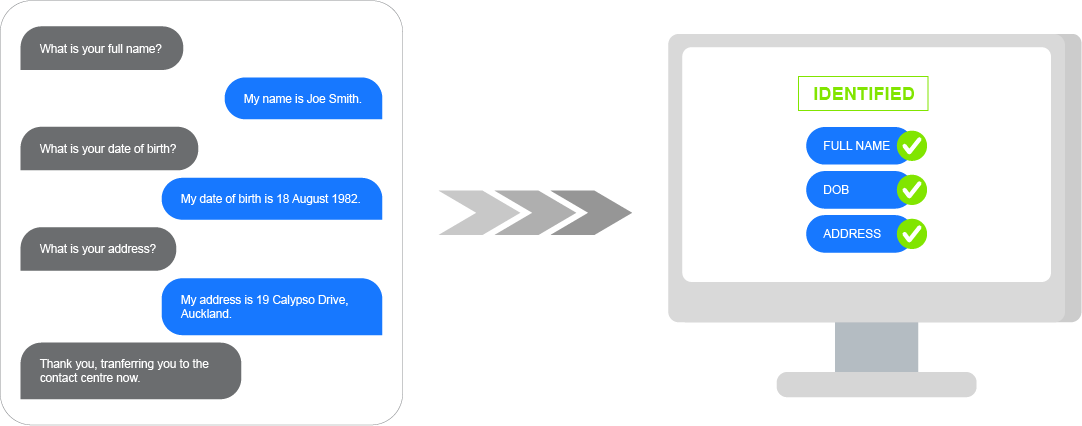

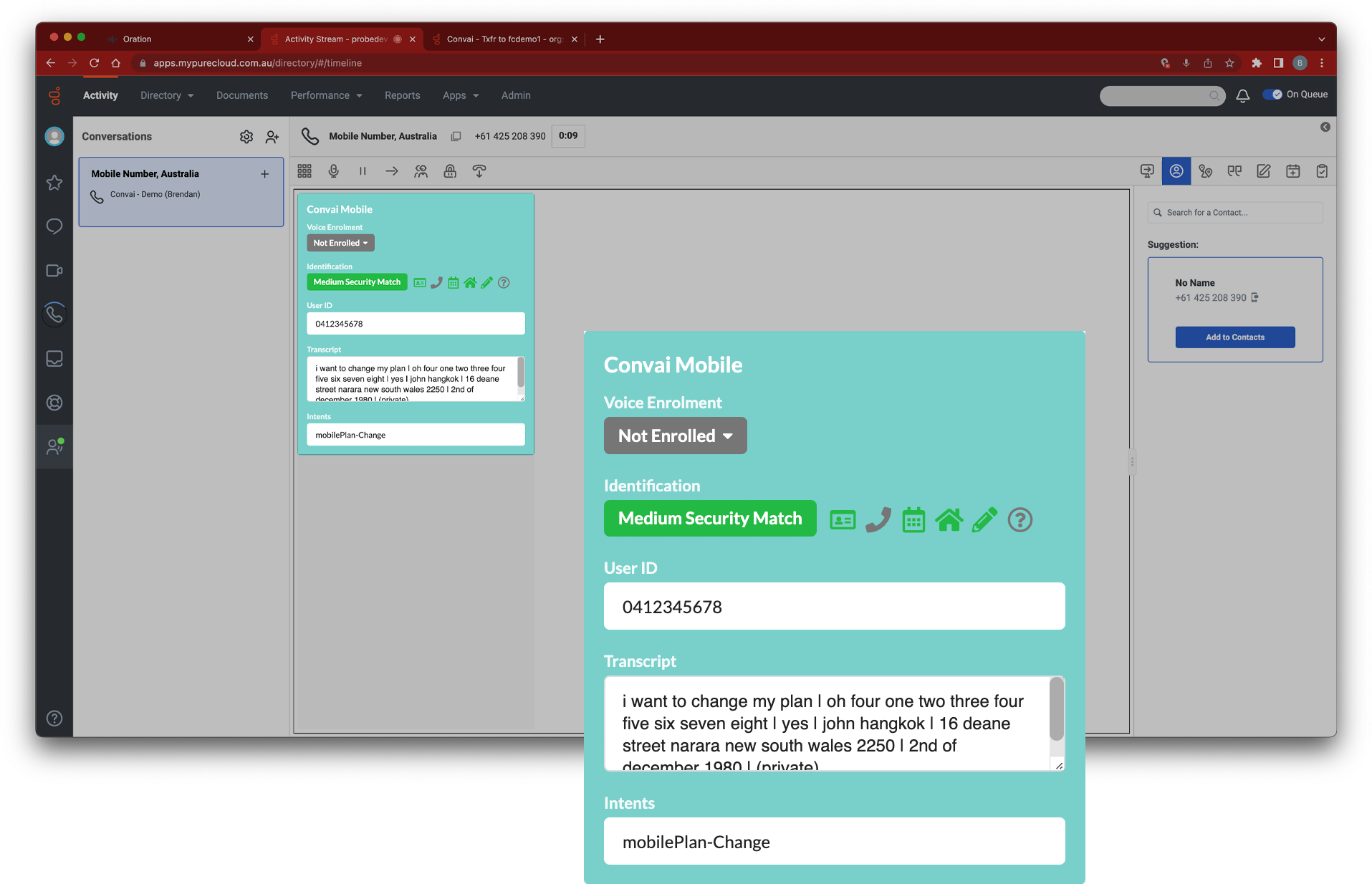

Oration offers two options for Automated KYC Verification: standard and full voice verification. In standard verification, Oration asks a series of questions (e.g. phone number, date of birth, address) to verify the caller's identity and then either offer self-service or transfer the call to an agent. The agent can see all information gathered by Oration and doesn't need to repeat the verification process.

With full voice verification, the caller can enrol their voiceprint through an agent. Then, confirming their identity is as simple as asking them to say their account number. Additionally, Oration can detect known or suspected fraudsters through its voiceprint database.

What makes Oration different?

Oration is an easy-to-use contact centre plugin designed to be implemented as an overlay to your existing contact centre technology infrastructure. A SaaS cloud-based solution, Oration can be up and running within a matter of days. Oration makes it easy for companies to comply with KYC regulations by offering voice verification technology. Agents can verify customers quickly and easily, while customers no longer need to remember complex information. The platform is simple for both agents and IT staff to use, and provides a secure and cost-effective solution for KYC verification.

Oration will:

Reduce average handling times

Reduce average handling times Identify and verify your callers

Identify and verify your callers  Increase uptake to self-service

Increase uptake to self-service  Provide targeted banners

Provide targeted banners  Facilitate a digital channel shift

Facilitate a digital channel shift  Improve agent and customer engagement

Improve agent and customer engagement  Support speed to competency

Support speed to competency

Discover Oration’s features

You can configure Oration’s features to your contact centre’s needs with or without Convai’s help - you choose what works best for you.

Overview of how Oration works

Watch Oration in action to see how easy it is to use and how it can better manage the conversations in your contact centre operations.

.png?width=3750&height=1323&name=Convai%20logo%20-%20final_Convai%20logo%20-%20final%20(1).png)