When it comes to contact centre metrics, few hold as much sway as average handle time (AHT). It has long been said that ‘time is money’ and never is that more so than in a world where every minute that a customer spends on a call is a minute an agent could have been handling another enquiry. Given the extensive variety of services managed by contact centres, there is no magic number for AHT but the clock is always ticking.

Agents can only do so much though and that is where knowledge-based authentication (KBA) enters the equation. Identifying a caller is one of the most crucial security measures for contact centres but can also have a huge impact on average handle time given the manual steps often required to prove an identity. The process of identifying a caller takes on average between one and two minutes, which may not seem like long, but is a sizeable percentage of what is considered an acceptable total call time of six minutes.

The good news is technology is increasingly playing a role in enhancing KBA processes. Research consultancy McKinsey & Co has found countries that adopt digital ID could generate value gains of 3% to 13% of GDP by 20301, while the identity verification market is estimated to soar from $11 billion in 2023 to $21 billion by 20282.

Given such numbers, it is no surprise that high-performing contact centres are embracing digital solutions that encompass knowledge-based authentication and, in turn, boost security and reduce call times.

What is knowledge-based authentication?

Knowledge-based authentication is an authentication method that requires callers to verify their identities based on a series of knowledge questions. This is done to prevent unauthorised people from accessing personal information and is based on the notion that only the actual owner of an account will know the details requested of them.

The digital KBA revolution

Technology is changing the game for contact centres willing to invest in tools that allow customers to verify their identities without needing to interact with human agents. A prime example is Oration by Convai, a cloud-based call routing plug-in that performs the identification and verification of callers by using one or more typical questions and including optional voice biometrics for added security and improved caller experience. Key benefits include:

Increased compliance

Taking the authentication process out of agents’ hands is not only a time saver but removes the risk of them taking shortcuts that can ultimately prove costly. It is not uncommon for some agents to fail to ask all the questions needed for verification and identification, which can be a nightmare when it comes to quality assurance.

Forget about pins

Everyone knows the feeling of being asked for a pin or identity number that was forgotten almost the moment it was created. After all, it’s one thing to remember a pin number for a regularly used bank account. It’s another to recall six digits that prove one’s identity when calling an insurance firm once a year. While traditional interactive voice response (IVR) systems require callers to enter pin numbers to prove their identities, Oration turns that process on its head by asking knowledge-based questions that would normally be required by agents.

Calling line identification

The first question typically asked by Oration is the phone number linked to their account and the use of ‘calling line identification’ technology allows the solution to automatically register the number from which the call has been received. When these two numbers match, it results in an instant confirmation, triggers the next step in the digital KBA process and saves precious time.

One-shot address

A caller’s address has long been a KBA token, with the traditional approach being for customers to provide their specifics in reverse order – postcode followed by street name and then street number – to allow systems to narrow down their searches. The combination of a modern speech engine with a Google Maps integration means Oration can simply request and verify a one-shot address. No need for reverse order. No need for multiple questions. No need to waste time.

Repositioning one-time codes

In the rush to boost security, many organisations are rushing to deploy two-factor authentication systems that typically contact centre agents to issue a one-time code via SMS or email, with callers then inputting the code – and it all takes time. Time for agents to explain they are going to send a code. Time for callers to wait for the SMS to land. Time for them to enter the digits. Manual two-factor authentication processes can add an entire minute to a call, whereas Oration has shifted the collection of one-time codes to the front of the IVR, ensuring callers reach an agent already fully authenticated.

Self-service opportunities

One of the great advantages of Oration’s ability to verify identity before agent involvement is it opens the opportunity to direct callers to self-service options. On the back of speech recognition technology that can identify intent, the solution can provide people with the option to solve an issue or find a resolution on their own. For example, an automated self-service function could allow them to access the balance of their superannuation account over the phone. Then, should they wish to change their investment mix, they could choose to be redirected to an agent but with the bonus of already being fully verified.

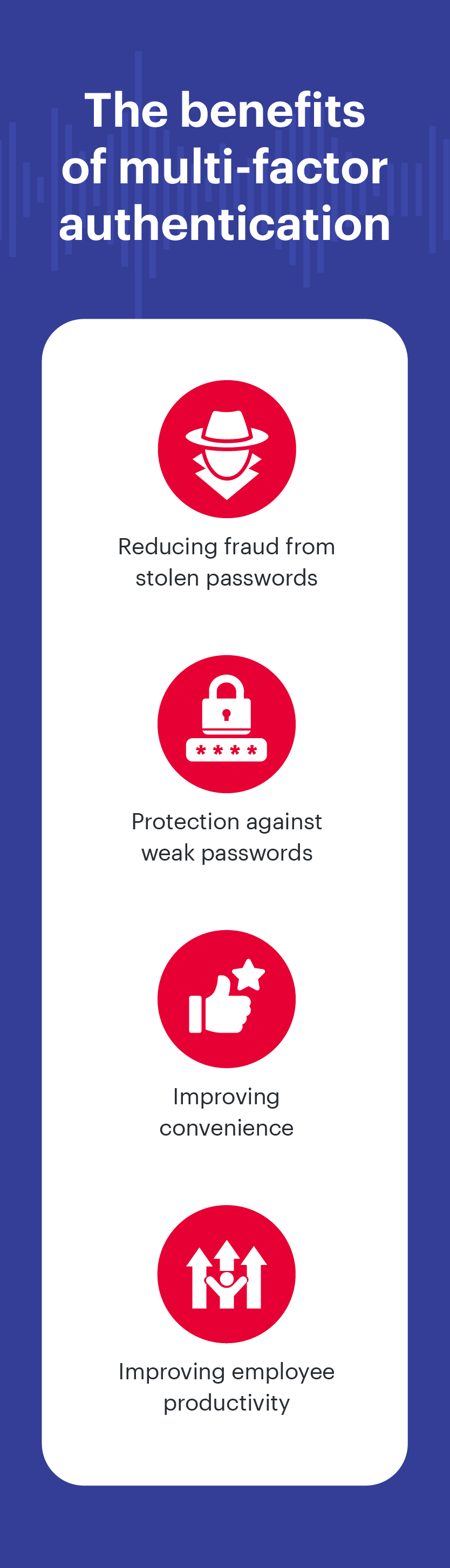

Source: Multi-Factor Authentication - How Does It Work? | Fraud.com

Oration in action

When you are a leading retailer with 50 outlets across Australia, the chance to reduce AHT by 53% and automate 82% of customer calls is the stuff of dreams. For one Convai client, that dream became a reality.

Faced with managing 60 IVR systems and, in turn, high wait times and low customer satisfaction, the retailer wanted to simplify its customer service operations and reduce queries regarding returns. As part of an extensive overhaul, Convai collaborated with Genesys and Probe Group to develop an automated voice persona that asked customers questions to identify them and locate their order information.

Oration then searched for orders using the caller’s phone number and customers who provided an order number were asked to provide personal details. The persona then matched the caller’s responses to their order details to confirm their identity. Customers had to complete the ID check before being connected with an agent, with the robot informing agents of the customer’s verification status through a screen pop.

After implementing the voice persona and further solutions, 82% of calls were processed through the Oration-powered automated voice persona and in just one month 31% of these calls were fully verified and 19% partially verified prior to the live agent transfer. This also resulted in AHT being reduced by 100 seconds for “where is my order?” calls and 209 seconds for general online shopping-related calls.

Summary

These are exciting times for contact centres. While there may be hurdles in the form of recruitment challenges and an uncertain economic climate, innovative tools and solutions are continuing to rewrite the landscape and providing forward-thinking managers with the opportunity to change the way they do business. Identify verification is just one such area and the even better news is the technology is only going to get better.

Do you want to free up your employees to focus on face-to-face interactions instead of handling calls? Discover how a leading health and wellness group used technology to reduce AHT by 180 seconds, save 233 reception hours per day and increase caller efficiencies by 75%.